The Great British Con: How “We’re Broke” Became the Lie That Keeps You Poor

Let me tell you a story about the most successful magic trick in modern politics. It’s not sleight of hand—it’s sleight of spreadsheet. And you, dear reader, are the mark.

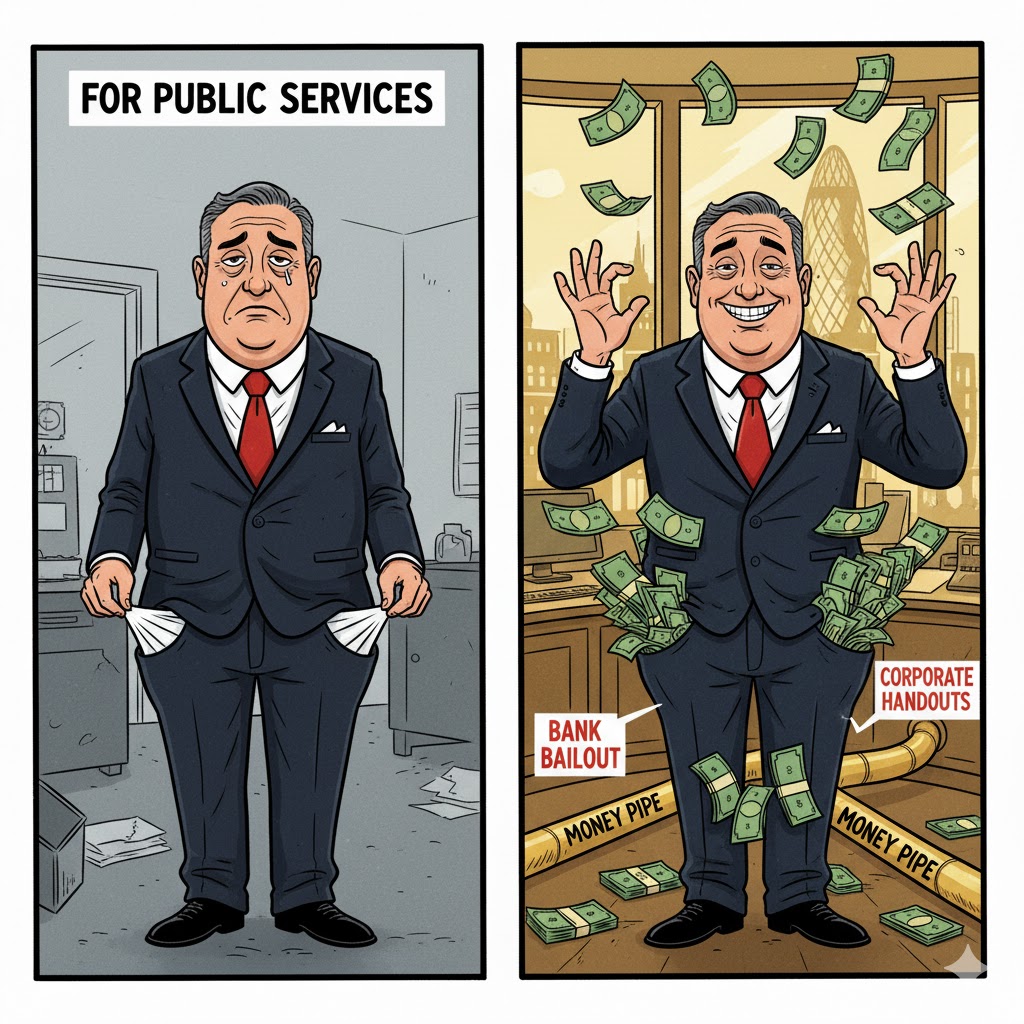

The trick goes like this: A government minister stands at a podium, face grave, voice trembling with fiscal responsibility. “We’d love to fix the NHS,” they say, “but we simply can’t afford it. The money’s run out. We must tighten our belts. We’re all in this together.”

Cut to six months later: A bank collapses. Suddenly, billions materialize overnight. No belt-tightening. No hard choices. Just money, appearing like manna from heaven—or more accurately, from a keyboard at the Bank of England.

Funny how that works, isn’t it?

The Austerity Con: Punishment Dressed as Policy

Here’s the uncomfortable truth that the pinstriped prophets of doom don’t want you to know: austerity isn’t an economic necessity. It’s a political choice. More specifically, it’s a weapon—one deliberately wielded to keep you in your place while the wealthy consolidate their grip on the economy.

Think about it. When did you last hear a billionaire worrying about “balancing the household budget”? When did a hedge fund manager fret about “living within our means”? They don’t, because they understand something about money that you’re not supposed to know.

The entire “we’re running out of money” narrative is, to put it bluntly, bollocks. It’s the economic equivalent of your parents telling you they couldn’t afford ice cream while hiding a freezer full of Ben & Jerry’s in the garage.

Enter Modern Monetary Theory: The Truth They Don’t Want You to Hear

Now, before your eyes glaze over at the phrase “Modern Monetary Theory,” stick with me. This is where it gets good—and dare I say, liberating.

MMT isn’t some radical new proposal. It’s simply a description of how money actually works right now, today, in the UK. Every single day, the Treasury tells the Bank of England to make payments. And every single day, the Bank of England doesn’t check if there’s enough money in the account first. It just does it. It creates the money with a few keystrokes—a number here, a corresponding entry there—and boom, money exists.

As tax justice campaigner Richard Murphy puts it: the Bank of England can create money “out of thin air by simply picking up a computer keyboard.” That’s not a bug in the system; that’s the system.

Here’s the kicker: tax doesn’t fund government spending. It never has.

Mind. Blown. Right?

Instead, tax serves a different purpose: it cancels out the inflationary pressure that would otherwise build up from government spending. It takes money out of circulation. That’s it. That’s the game.

Government bonds? Also not funding spending. They’re basically just a safe parking spot for money the government has created but hasn’t taxed back yet.

So Why the Hell Are We Being Told We’re Broke?

Excellent question. Let’s follow the money—or rather, let’s follow who benefits from you believing there isn’t any.

When you accept that “we can’t afford it,” you accept:

- Crumbling schools

- Endless NHS waiting lists

- Potholes the size of paddling pools

- A housing crisis that prices out an entire generation

- Climate change policies perpetually kicked down the road

You accept managed decline. You accept less. You lower your expectations of what government should provide. And most importantly, you stop asking uncomfortable questions about where all the wealth is actually going.

Meanwhile, the wealthy—oh, they understand MMT perfectly. They’ve been leveraging it for decades.

The Casino Capitalists: How the Rich Already Use MMT (For Themselves)

Let’s talk about hedge fund managers like Crispin Odey, shall we? These disaster capitalists don’t just understand that money can be created—they’ve built entire business models around it. They make fortunes by betting on economic shocks, knowing full well that when things go tits up, there’s always a “too big to fail” safety net waiting.

Banks create money too—they’re supposed to balance their books with cash reserves, but history shows us what happens when they mess up: they get bailed out. With money that apparently didn’t exist for your local hospital, but magically materialized for Barclays.

This is what the French economist Thomas Piketty might call “patrimonial capitalism”—or what us regular folk might call “heads I win, tails you lose.”

And look across the pond. Trump isn’t just governing America—he’s looting it, using the government’s money-creating power for personal enrichment, secure in the knowledge that Uncle Sam’s credit is always good for a bailout. It’s MMT for me, austerity for thee, taken to its grotesque extreme.

Gary Stevenson: Fighting Fire with Their Own Matches

This is where former trader Gary Stevenson enters the ring. With 1.4 million YouTube subscribers (compared to most economics professors’ handful), Gary’s doing something remarkable: he’s beating the elite at their own game by speaking their language.

Gary worked in the belly of the beast. He knows how traders think, how markets move, how the wealthy view the economy. And he’s using that knowledge to make an argument even within the current rigged system: we need to tax the top 1% not out of spite, but out of survival.

Because here’s what Gary sees: the wealth concentration has become so extreme that it’s breaking the system even for the capitalists. When billionaires hoard so much wealth that everyone else is squeezed dry, who’s going to buy their products? Who’s going to prop up their asset prices?

It’s not about fairness (though it should be). It’s about preventing societal collapse. Even if you play by their rules, using their framework, the math still says: tax the rich or watch it all burn.

Gary’s framing might sometimes simplify complex theory—but you know what? It works. It cuts through. Because sometimes you need to speak the language of the market to show the market it’s doomed.

Richard Murphy: The Optimistic Revolution

But here’s where it gets really exciting. Richard Murphy takes it further. Much further.

Murphy says: Why are we playing defence? Why are we arguing for crumbs? The government already uses MMT—they’re just using it to serve the City of London instead of you.

His vision? Flip the script entirely.

What if the government openly acknowledged it can create money and used that power to:

- Transform the NHS

- Create a green energy infrastructure that would be the envy of the world

- Fund actual job creation in left-behind regions

- Invest in skills, education, and care

“But the markets will panic!” cry the doomsayers.

Murphy’s response is gloriously practical: Let them. Then manage it. Here’s how:

If bond markets throw a tantrum:

- Tell the Bank of England to cut interest rates (they control them anyway—we saw this from 2009 to 2022)

- Stop issuing new bonds temporarily—flood banks with cash instead, forcing rates down

- Stop the ridiculous “quantitative tightening” program that’s serving no one but ideology

- Buy back bonds at discount prices if they fall (exactly what businesses do)

If the pound falls:

- Brilliant! UK exports become competitive again

- Manufacturing jobs return

- We break free from the “finance curse” that keeps the pound overvalued

If foreign investors flee:

- Offer bonds directly to UK citizens through National Savings & Investments

- Over £100 billion sits in ISAs this year—redirect it to productive investment

- Let people invest in “Southwest England Funds” or “Northeast England Funds”

- Give Brits a stake in their own country’s future

This isn’t fantasy. This is using the exact same monetary mechanisms that currently serve the 1% to serve the 99% instead.

The Competition Myth: Why You’re Not Playing Sports

Here’s a thought that keeps me up at night: When capitalists defend their system, they talk about “competition.” And I think most regular people hear that word and think of sports—a level playing field, fair rules, may the best person win.

That’s exactly what they want you to think.

But this isn’t the Premier League. This isn’t even Sunday league football. It’s more like a match where one team starts with a 50-goal lead, has bought the referee, can change the rules mid-game, and gets points every time you don’t score.

The game is rigged. The biggest players aren’t just winning—they’re cheating. And they’ve convinced you to admire them for it.

Billionaires aren’t Olympians who trained harder than you. They’re people who figured out the rules were negotiable and hired lobbyists to rewrite them. Corporations aren’t scrappy underdogs competing fairly—they’re monopolistic giants who crush competition and then claim their dominance proves the system works.

Once you see the rigging, you can’t unsee it. And increasingly, people are seeing it.

Making It Digestible: The Message We Need

So how do we distill Murphy’s optimistic revolution into something your uncle Dave at the pub would understand?

Try this:

“The government isn’t like a household budget. It’s like the bank in Monopoly—it literally makes the money. Right now, they’re making that money and handing it to their rich mates. We’re saying: make it and invest it in us instead. Build houses. Fix the NHS. Create jobs. And use taxes on the wealthy to stop inflation, not to ‘pay for’ spending.”

Or this:

“You know how banks got billions overnight in 2008? That money wasn’t found down the back of a sofa. It was created. The same way they could create money to fix your kid’s school tomorrow. They’re choosing not to. Ask yourself why.”

Or simply:

“Austerity is a choice, not a necessity. And it’s not your fault—it’s class warfare dressed up as bookkeeping.”

The Bottom Line (Up Front)

Here’s your TL;DR, your takeaway, your rallying cry:

The UK government cannot run out of pounds. It creates them. The question has never been “can we afford it?” The question is: “Do we have the real resources—the workers, materials, skills—to do it without causing inflation?”

And the answer to that question, for most of what we desperately need, is a resounding yes.

Austerity isn’t fixing anything. It’s not even trying to. It’s a mechanism of control, a tool to keep you grateful for scraps while the wealthy feast. It maintains the fiction that we’re all in competition together when really, they’ve already won and are just running up the score.

But here’s the hope: The system they’re using against us is the same system we could use for ourselves. MMT isn’t a radical proposal—it’s just telling the truth about how money works and asking, “What if we used this truth to build a better country?”

Gary Stevenson is showing us we need to act even within their broken framework. Richard Murphy is showing us we could break the framework itself and build something beautiful.

The only question left is: Do we have the courage to demand it?

Because I promise you this: They’ll keep telling you we’re broke right up until the moment the next bank needs a bailout. Then suddenly, money will appear. As if by magic.

It was never magic. It was always a choice.

Time to choose differently.

Now, who’s ready to stop playing a rigged game and start flipping the table?